Why Brokers are Choosing Non Bank Lenders

In the competitive realm of commercial real estate, the need for swift action and adaptability to market changes is paramount. Traditional banks, with their rigid procedures and extended approval timelines, often fall short in delivering the speed and flexibility required. Enter Non Bank Lenders, who provide a unique combination of quick processing, adaptability, and dependability. This makes them a preferred choice for many commercial property brokers seeking commercial property loans.

1. Non Bank Lenders = Speedy Approvals and Quick Closings

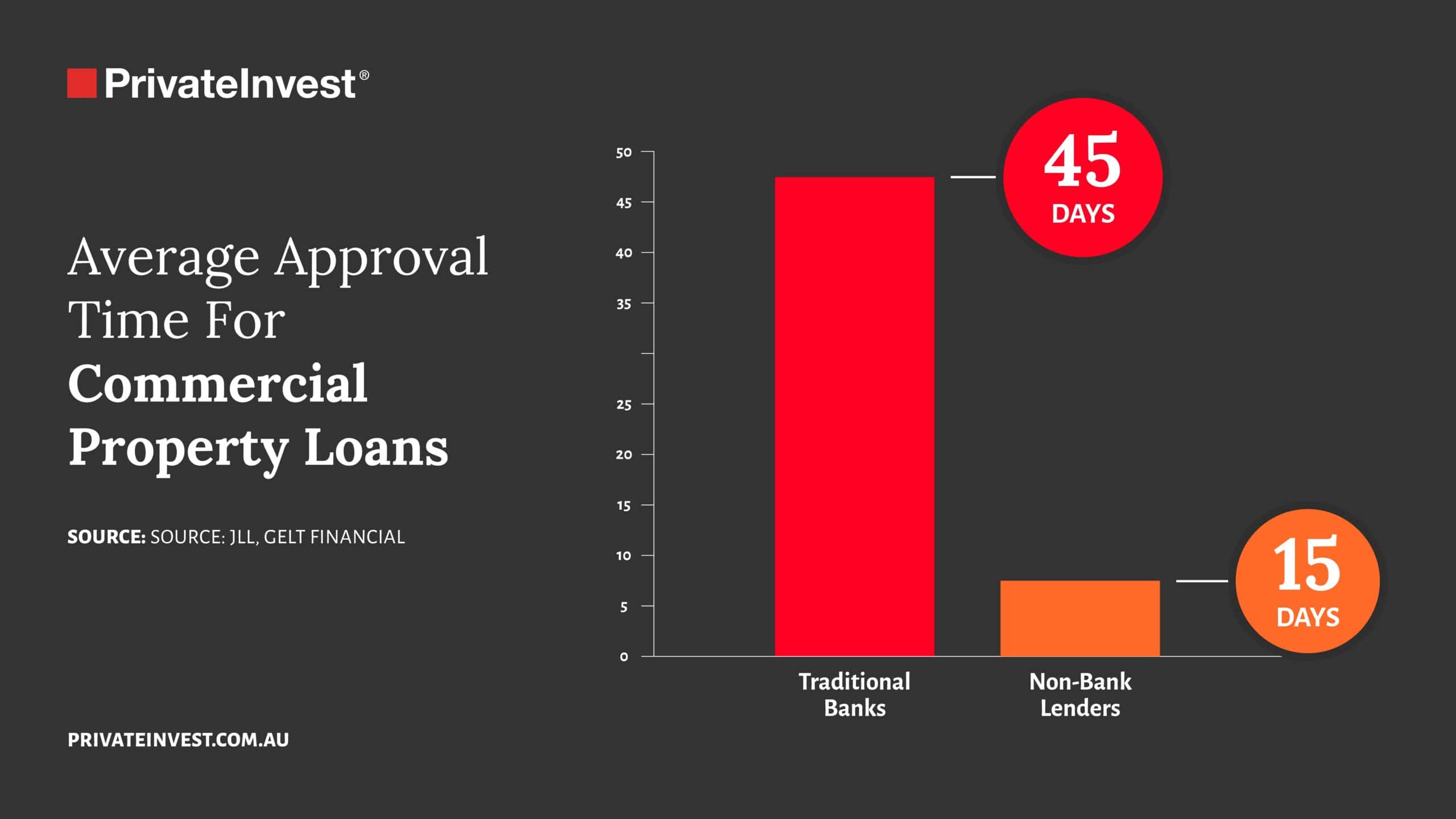

A significant benefits of non bank lenders is their capacity to approve commercial property loans and finalise deals swiftly. In commercial real estate, timing is crucial. Traditional banks often demand extensive documentation and a protracted review process, leading to delays and potential missed opportunities. Non Bank Lenders on the other hand, employ procedures and minimal bureaucracy, enabling them to approve loans in days. This rapid turnaround allows brokers to seize profitable opportunities before their competitors can.

2. Flexible Financing Options for Non Bank Lenders

3. Willingness to Finance Diverse Property Types

Traditional banks often employ conservative lending practices that may exclude certain types of properties or projects perceived as too risky. Non Bank Lenders , however, are typically more open to financing a diverse array of commercial properties, including those that may not meet the rigid criteria of traditional banks. From niche markets to unconventional developments, they can provide brokers with the opportunity to explore and invest in a broader spectrum of properties. This openness allows brokers to expand their portfolios and achieve greater success.

4. Personalised Service and Relationship Building

5. Competitive Rates and Terms

Although Non Bank Lenders might sometimes charge higher interest rates compared to traditional banks, the overall value they offer often outweighs the cost. The flexibility, speed, and customised solutions provided by Non Bank Lenders can lead to significant long-term savings. Brokers can secure financing for deals that might otherwise be out of reach, ultimately driving higher profits. Additionally, they are increasingly offering competitive rates and terms, making them an appealing alternative even for cost-conscious brokers.

6. Enhanced Client Satisfaction

Collaborating with Non Bank Lenders enables brokers to deliver a superior level of service to their clients. The ability to offer fast approvals, flexible financing options, and personalised attention greatly enhances client satisfaction and loyalty. Clients who experience smooth and successful transactions are more likely to return for future deals and refer their broker to others. This heightened client satisfaction not only boosts the broker’s reputation but also contributes to long-term business growth.

Conclusion

In the dynamic world of commercial real estate, brokers require financing partners who can meet their demands and support their success. Non Bank Lenders, with their swift approvals, flexible financing options, and personalised service, have emerged as the preferred choice for many commercial property brokers seeking commercial property loans. By partnering with them, brokers can navigate market complexities confidently, close deals efficiently, and deliver exceptional results for their clients. For brokers aiming to enhance their competitive edge and achieve greater success in the commercial real estate market, leveraging the advantages of Non Bank Lenders is a strategic move that promises substantial rewards.

About PrivateInvest

PrivateInvest is an Australian Investment Fund Manager + Private Commercial Credit Partner / Non Bank Lender to the Property Sector providing a suite of bespoke financial services to investors and borrowers.

Wholesale Investors rely on PrivateInvest to deliver above average risk altered returns in the commercial real estate debt market. We achieve this through equity, mezzanine debt, preferred equity, and hybrid debt instruments.

Qualified borrowers in the middle market segment access capital from PrivateInvest for tailored property financing. PrivateInvest provides support and personalised solutions that borrowers “can bank on”.

Share your thoughts on “Why Brokers are Choosing Non Bank Lenders“ via your social channels with the button below.