Commercial Property Loans: How to Maximise Profits

In the dynamic world of commercial real estate, securing the right financing is paramount. Traditional banks, while reliable, often have rigid criteria and slow approval processes that can hinder the agility required in today’s fast-paced market. Enter non bank lenders, a growing force in the commercial property loans landscape. For brokers looking to maximise profits and close deals efficiently, partnering it offers numerous advantages.

1. Flexibility in Financing Solutions for Commercial Property Loans

Non bank lenders excel in providing flexible financing options tailored to the unique needs of each commercial property loan deal. Unlike traditional banks, which adhere to stringent guidelines and standardised loan packages, non bank lenders can offer customised solutions. Whether it’s a bridge loan, mezzanine financing, or a specialised loan structure, non bank lenders have the adaptability to craft terms that align with the specific requirements of the property and the borrower.

2. Faster Approval and Closing Times

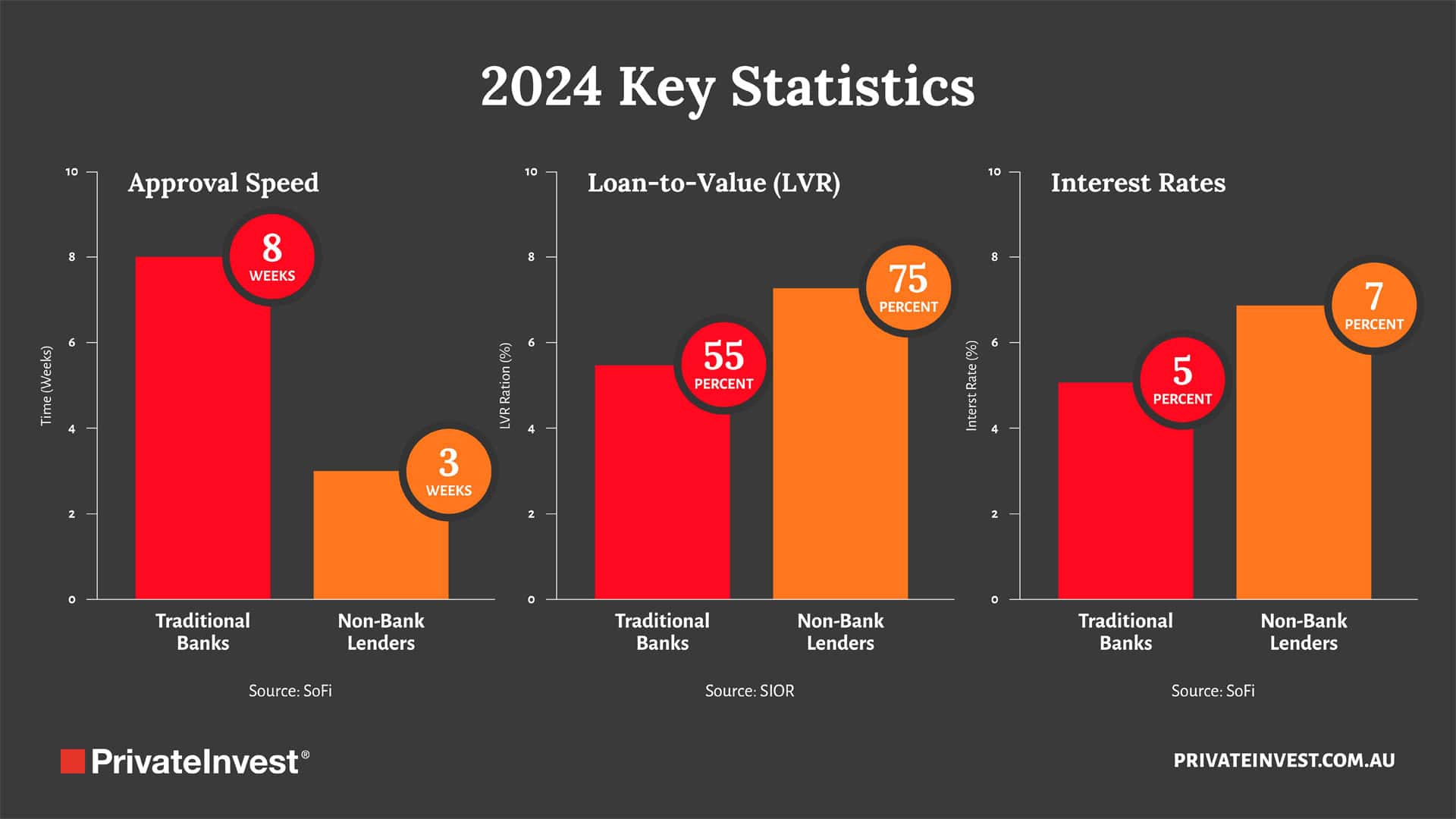

Time is often of the essence in commercial real estate transactions. The lengthy approval processes of traditional banks can lead to missed opportunities. Non bank lenders, on the other hand, are known for their expedited approval and closing timelines. With streamlined procedures and fewer bureaucratic hurdles, non bank lenders can move quickly, enabling brokers to secure funding and close commercial property loans without unnecessary delays.

3. Competitive Interest Rates and Fees

A common misconception is that non bank lenders charge exorbitant interest rates and fees. While it’s true that they sometimes may have slightly higher rates compared to traditional banks, they often offer competitive pricing that reflects the risk and flexibility they provide. Moreover, the speed and customisation of their lending solutions can result in overall cost savings, as brokers can seize lucrative opportunities that might otherwise be lost.

4. Access to a Wider Range of Properties

Traditional banks often have conservative lending criteria that can exclude certain types of commercial properties or non-conventional projects. Non bank lenders are typically more willing to finance a broader spectrum of properties, including those deemed too risky by traditional institutions. This openness allows brokers to explore and capitalise on a wider range of investment opportunities, from emerging markets to innovative developments.

5. Enhanced Client Relationships

By partnering with non bank lenders, brokers can offer their clients a superior level of service and more financing options. This ability to provide customised solutions and quicker turnaround times can significantly enhance client satisfaction and loyalty. When clients know they can rely on their broker to secure the best possible financing, they are more likely to return for future deals and recommend the broker to others.

6. Increased Deal Flow for Commercial Property Loans

The combination of flexible financing, faster approvals, and the ability to work with a diverse range of properties leads to increased deal flow for brokers. With non bank lenders, brokers are not constrained by the limitations of traditional financing. This allows them to pursue more opportunities and close more commercial property loans. This increased activity translates directly to higher profits and a more robust business.

7. Strategic Partnership and Support

Non bank lenders often view their relationships with brokers as strategic partnerships. They provide not only financing but also valuable support and expertise. Brokers can benefit from the non bank lender’s market insights, risk assessment capabilities, and industry connections. This collaborative approach helps brokers navigate complex transactions and achieve successful outcomes for their clients.

Conclusion

In the competitive world of commercial real estate, brokers need every advantage to maximise profits and deliver exceptional results for their clients. Partnering with non bank lenders offers a wealth of benefits, from flexible and customised financing solutions to faster approval times and enhanced client relationships. By leveraging the strengths of non bank lenders, commercial property brokers can unlock new opportunities and drive greater success.

For brokers, exploring partnerships with non bank lenders is a strategic move that promises significant.

About PrivateInvest

PrivateInvest is an Australian Investment Fund Manager + Private Commercial Credit Partner / Non Bank Lender to the Property Sector providing a suite of bespoke financial services to investors and borrowers.

Wholesale Investors rely on PrivateInvest to deliver above average risk altered returns in the commercial real estate debt market. We achieve this through equity, mezzanine debt, preferred equity, and hybrid debt instruments.

Qualified borrowers in the middle market segment access capital from PrivateInvest for tailored property financing. PrivateInvest provides support and personalised solutions that borrowers “can bank on”.

Share your thoughts on “Maximising Profits for Commercial Property Loans“ via your social channels with the button below.