What are Non Bank Lenders ?

In the realm of finance, traditional banks have long been the go-to institutions for loans and credit. However, in recent years, a new alternative has emerged – Non Bank Lenders.

These institutions, often referred to as Alternative Banks, or Private Lenders, offer a point of difference to conventional banks, providing individuals and businesses alike with flexible solutions tailored to their unique needs. But how exactly do they work, and what sets them apart? Let’s explore the world of Non Bank Lenders to understand their operations and the benefits they offer.

Unlike Traditional Banks, Alternative Lenders don’t rely solely on customer deposits to fund their lending activities. Instead, they tap into a diverse range of funding sources, including institutional investors, hedge funds, private equity firms, and even more. This diversity enables them to access capital more efficiently and offer competitive rates and terms to borrowers.

Non Bank Lenders: A Streamlined Processes and Specialised Expertise

One of the standout features of Private Lenders is their streamlined lending processes. As they operate with more freedom to Traditional Banks, these institutions leverage technology and data analytics to expedite loan approvals. As a result, borrowers can access much-needed funds quickly, sometimes within a matter of days rather than weeks.

Non Bank Lenders often specialise in niche markets, allowing them to develop deep expertise in those areas. Whether it’s real estate financing or small business loans these institutions understand the unique needs and challenges of their borrowers. This specialised knowledge translates into more personalised service and tailored solutions that Traditional Banks may struggle to match.

Flexible Terms, Accessibility, and Inclusivity

Flexibility is the hallmark of Non Bank Lending. These institutions are not bound by the same constraints as Traditional Banks, allowing them to offer flexible terms to borrowers. Whether it’s a longer repayment period, interest-only payments, or adjustable rates, Non Bank Lenders can customise loan packages to suit the specific circumstances and preferences of their clients.

Non Bank Lenders play a crucial role in promoting financial inclusion by serving segments of the population that may have difficulty accessing credit through traditional channels. This includes entrepreneurs with limited credit history, individuals with non-traditional sources of income, and small businesses in underserved communities. By offering alternative lending options, Private Lenders empower these individuals and businesses to pursue their goals and contribute to growth.

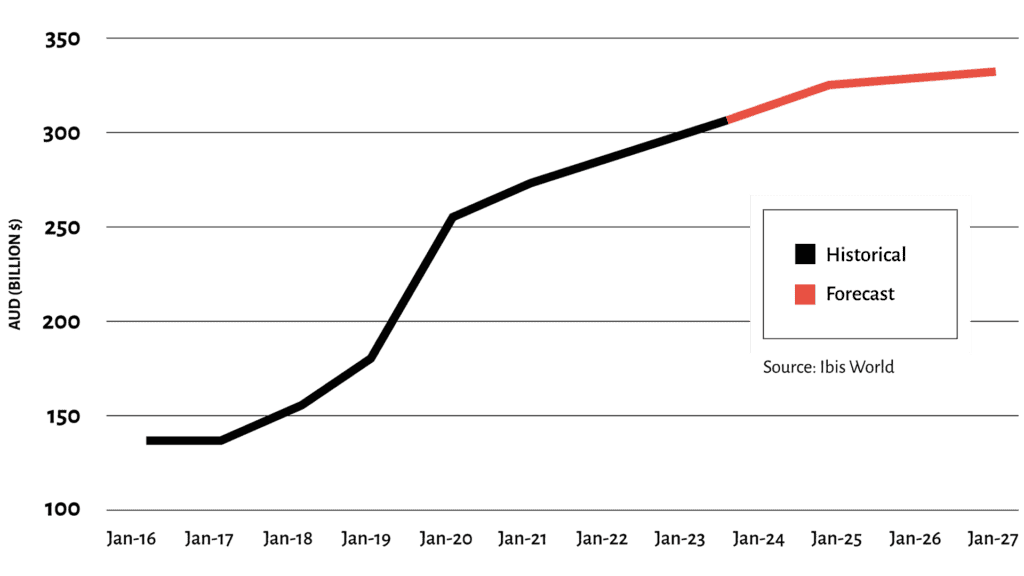

Ibis World recently reported that Non Bank Lending is forecasted to grow to $336.67 (AUD) billion by 2026-27.

Conclusion

In an increasingly interconnected and fast-paced world, Non Bank Lenders offer a valid point of difference in the world of lending. With their diverse funding sources, streamlined processes, specialised expertise, and flexible terms, they are reshaping the lending landscape and providing individuals and businesses with the tools they need to thrive. As we move forward, it’s clear that non-bank lenders will continue to play a vital role in driving innovation and expanding access to capital for all.

About PrivateInvest

PrivateInvest is a funds manager and non bank lender in the Australian property sector, providing a suite of bespoke financial services to investors and borrowers.

Wholesale Investors rely on PrivateInvest to deliver above average risk adjusted returns in the commercial real estate debt market. We achieve this through equity, mezzanine debt, preferred equity, and hybrid debt instruments.

Qualified borrowers in the middle market segment access capital from PrivateInvest for tailored property financing. PrivateInvest provides support and personalised solutions that borrowers “can bank on”.

Share your thoughts on What are Non Bank Lenders? via your social channels with the button below.