Private Credit: 2024’s Smart Money Investment

In 2024, savvy investors are turning their attention to Private Credit as an opportunity for robust returns and portfolio diversification.

Private Credit: A Superior Yield Performance

Private Credit investments are known for their high yield potential. In 2024, Private Credit funds are anticipated to deliver returns between 8% and 12%, outstripping the performance of traditional assets. These fixed-income traditional assets include government bonds and public corporate debt.

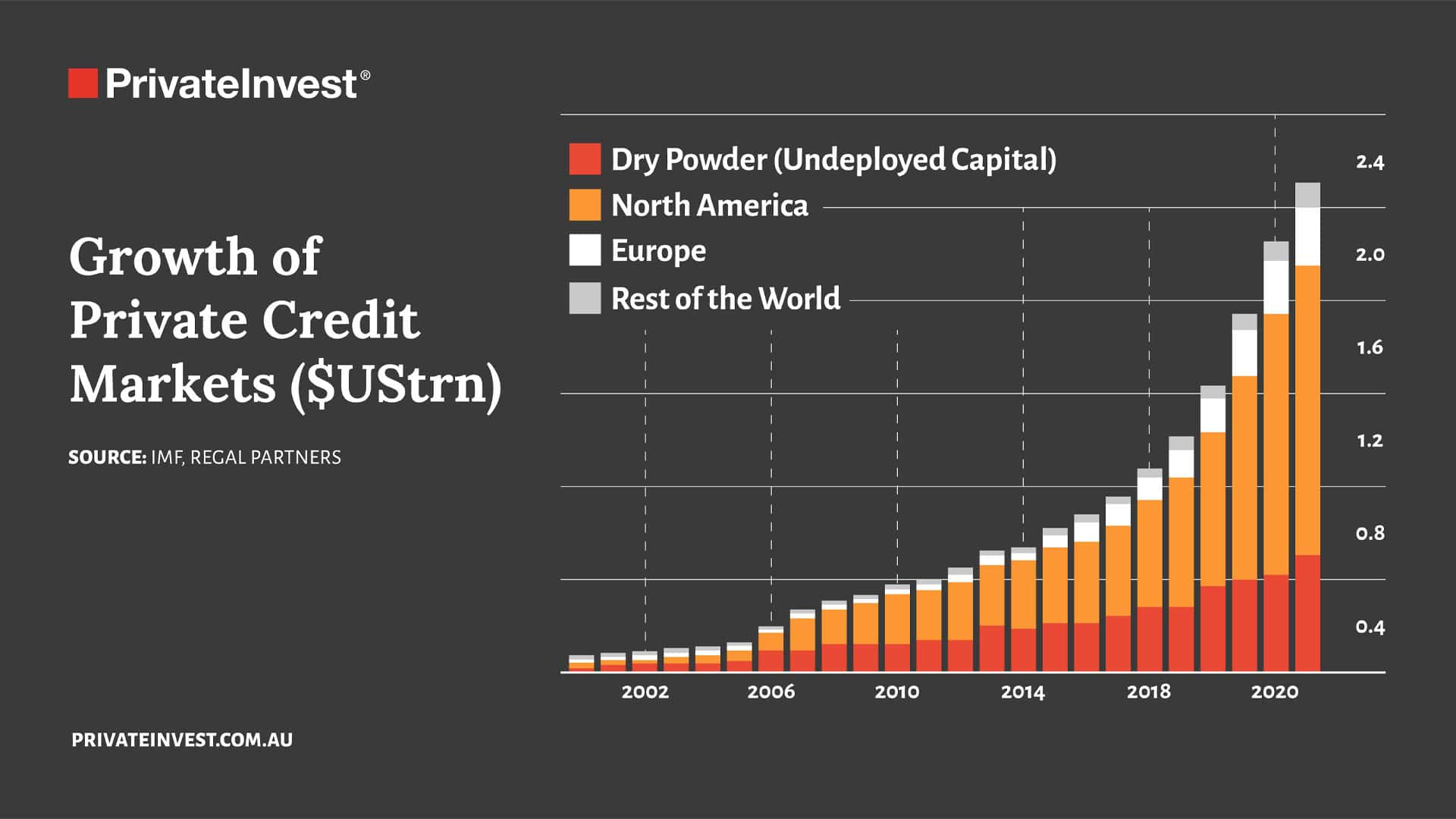

According to data from Preqin, the Private Debt market has experienced a robust annual growth rate of 15% since 2020. This resulted in Private Debt reaching an unprecedented $1.3 trillion in assets under management (AUM) by the start of 2024. This strong performance underscores the asset class’s ability to generate superior returns.

Private Credit's Resilience and Low Market Correlation

One of the assets distinguishing features, is its low correlation with public equity and bond markets. This makes Private Credit an excellent diversification tool, helping to mitigate portfolio risk. Amidst the volatility of equity markets driven by geopolitical tensions and economic uncertainties, Private Credit provides a stable investment alternative.

According to PitchBook, Private Debt investments have maintained a correlation of less than 0.3 with major stock indices. This resulted in enhancing portfolio resilience against market downturns.

Attractive Risk-Adjusted Returns

Private Debt often involves senior secured loans, which are higher in the capital structure and backed by collateral. This offers better protection against borrower defaults. This structural advantage translates to attractive risk-adjusted returns.

In 2024, the default rate in the Private Debt market has remained below 2%, significantly lower than the 4% default rate observed in the high-yield corporate bond market. Additionally, the spread between private lending rates and traditional lending rates has widened, offering investors enhanced compensation for credit risk.

Rising Demand and Supply Constraints

The demand for Private Credit continues to surge, driven by the need for alternative financing solutions among middle-market companies. Traditional banks have scaled back their lending activities to these firms due to regulatory constraints and higher capital requirements, creating a substantial market opportunity for Private Credit providers. In 2024, the Private Credit market is projected to see a 20% increase in deal flow, with middle-market lending constituting many of these transactions.

Favourable Economic Conditions

The economic landscape in 2024 is conducive to the assets growth. With interest rates stabilising and inflation pressures easing, Private Credit offers a flexible and attractive financing option for borrowers. In the United States, The Federal Reserve has indicated that interest rates are expected to remain within a range of 3% to 4%. This creates a stable environment for private lending worldwide. This stability encourages companies to seek Private Credit for expansion and operational needs, further boosting the sector’s growth.

Regulatory Support

Regulatory changes in 2024 have also enhanced the attractiveness of Private Debt. Recent modifications to the Dodd-Frank Act have reduced some of the regulatory burdens on private lenders, facilitating easier operation and expansion. These regulatory adjustments have led to increased competition among private credit funds, benefiting investors through more favourable terms and reduced fees.

Conclusion

Private Credit boast multiple positive attributes that make it a great investment in 2024. Those include, the ability to deliver high yields, its low correlation with public markets, attractive risk-adjusted returns, and the growing demand-supply gap. Supported by a favourable economic environment and regulatory landscape, Private Debt stands out as a robust option for investors seeking stability and high returns. For those looking to enhance their investment portfolios amidst economic uncertainties, this asset offers a compelling and strategic investment opportunity in 2024.

About PrivateInvest

PrivateInvest is an Australian Investment Fund Manager + Private Commercial Credit Partner to the Property Sector providing a suite of bespoke financial services to investors and borrowers.

Wholesale Investors rely on PrivateInvest to deliver above average risk altered returns in the commercial real estate debt market. We achieve this through equity, mezzanine debt, preferred equity, and hybrid debt instruments.

Qualified borrowers in the middle market segment access capital from PrivateInvest for tailored property financing. PrivateInvest provides support and personalised solutions that borrowers “can bank on”.

Share your thoughts on Why Private Credit is 2024’s Smart Money Investment via your social channels with the button below.