Why Private Credit is the New Private Equity

In the domain of alternative investments, private equity has been prominent, attracting investors interested in high returns and active involvement. Nonetheless, a new contender has emerged, steadily gaining momentum, and influencing the dynamics of private investing: Private Credit. Offering a mix of consistent income, risk mitigation, and portfolio diversification, Private Credit is the up-and-coming asset class of the alternative investment world.

The Rise of Private Credit

Private Credit, also known as Private Debt, includes different lending activities: direct lending, mezzanine financing, and distressed debt investments. Unlike traditional bank lending, which encounters growing regulatory constraints, private credit providers operate autonomously from the banking system. They offer customised financing solutions to a diverse array of borrowers.

The low-interest-rate environment after the global financial crisis has significantly fueled the expansion of Private Credit. Central banks maintaining historically low interest rates have caused traditional fixed-income investments to struggle in generating significant returns. Conversely, Private Debt has emerged as an appealing alternative, providing investors with higher yields and stable income streams.

Stable Income and Downside Protection

Private Credit holds a significant allure due to its ability to generate consistent income streams. These streams are often characterised by contractual interest payments and scheduled amortisation. Unlike Private Equity, which relies on capital appreciation for returns, Private Credit assures investors predictable cash flows. This quality makes it an attractive option for those pursuing income stability, such as pension funds, insurance companies, and high-net-worth individuals.

Moreover, Private Debt investments typically occupy a senior position in the capital structure. This positioning grants them priority access to the borrower’s assets in case of default or bankruptcy. Such seniority provides investors with protection against risks, reducing the potential for capital losses compared to equity investments. In an uncertain economic climate characterised by volatility, the defensive attributes of private credit can furnish investors with needed stability.

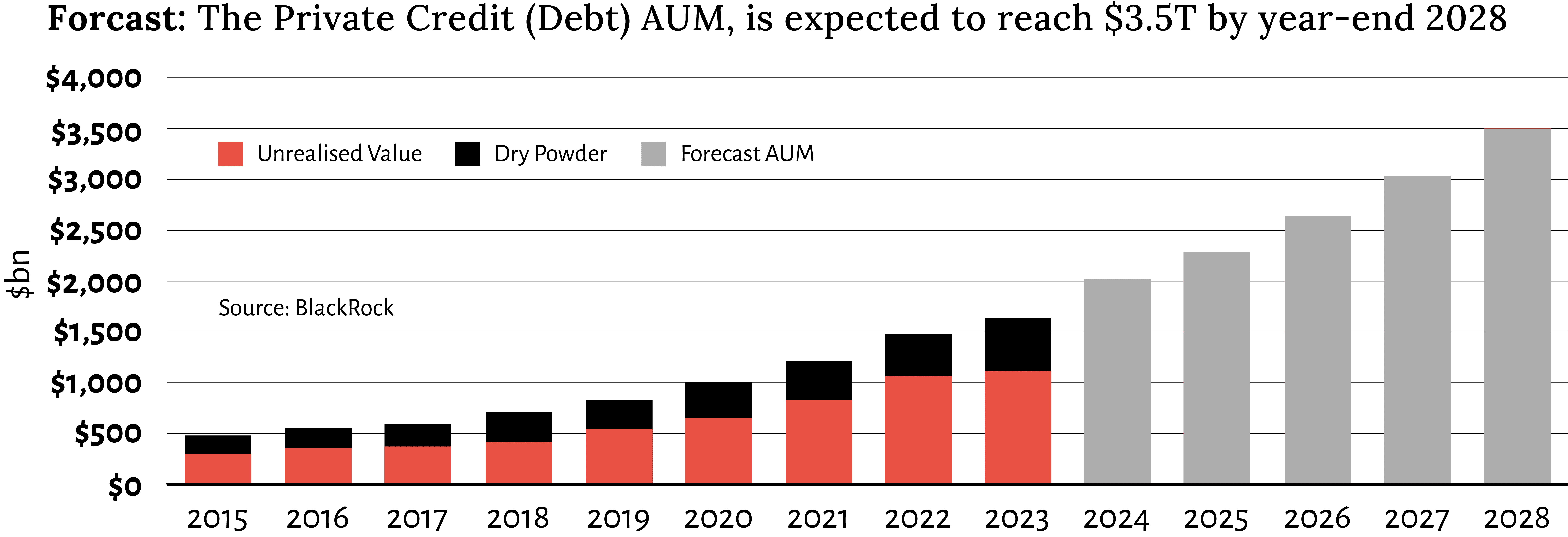

According to BlackRock, the global Private Debt market (AUM) is projected to reach $3.5 trillion by the end of 2028.

Diversification Benefits

In addition to its attributes of stable income and protection against risks, private credit presents diversification advantages, particularly within a balanced investment portfolio. Private Credit demonstrates minimal correlation with traditional asset classes like stocks and bonds, making it an effective diversifier capable of easing overall portfolio volatility and enhancing risk-adjusted returns.

Moreover, Private Debt investments includes a broad spectrum of industries and geographic regions. This affords investors opportunities to construct diversified portfolios tailored to their risk preferences and investment objectives. Whether engaging in direct lending to middle-market companies, distressed debt investments in troubled scenarios, or structured debt in specialised sectors, Private Credit offers many options for investors aiming to expand their investment horizons and capture additional sources of returns.

Conclusion

Private Credit is gaining recognition as a counterpart to Private Equity, offering investors a compelling blend of stable income, reducing risk, and a range of advantages. In a landscape marked by low interest rates, market volatility, and evolving dynamics, Private Credit emerges as an appealing alternative investment capable of delivering risk-adjusted returns across various market conditions.

Investors continue to seek ways to enhance portfolio returns and manage risk effectively, positioning Private Debt to assume a more significant role in both institutional and individual investor portfolios. With its established performance history, defensive attributes, and array of investment opportunities, private credit is well-positioned to thrive within the evolving realm of alternative investments. It solidifies its position as a prominent choice in the private investing domain.

About PrivateInvest

PrivateInvest is a funds manager and lender in the Australian property sector, providing a suite of bespoke financial services to investors and borrowers.

Wholesale Investors rely on PrivateInvest to deliver above average risk altered returns in the commercial real estate debt market. We achieve this through equity, mezzanine debt, preferred equity, and hybrid debt instruments.

Qualified borrowers in the middle market segment access capital from PrivateInvest for tailored property financing. PrivateInvest provides support and personalised solutions that borrowers “can bank on”.

Share your thoughts on What Private Credit is the New Private Equity? via your social channels with the button below.